Throughout the employment application and interview process, you are “selling” yourself for the position you are seeking. The first thing that you need to do when seeking a new job is to accurately and honestly assess the skills and abilities that you have. It makes no sense to be pursuing a position as a Database Architect if you have no experience or skills in the software domain. The same applies to your credit report. Will your credit report make you an attractive candidate to a potential employer?

Your credit report contains more personal and private information than most people share with their families and closest friends. A basic credit report contains the following:

- Your social security number

- Your current address

- Your prior addresses

- Your type of residence/mailing address

-

- Post office box

- Apartment complex

- Single family residence

- Multifamily residence

-

- Geographical code of your residence

-

- (Identifies the neighborhood in which your residence is located.)

-

- Your telephone number

- Other names you have used

- Your prior employers, position, and employment dates

- Your spouse’s first name

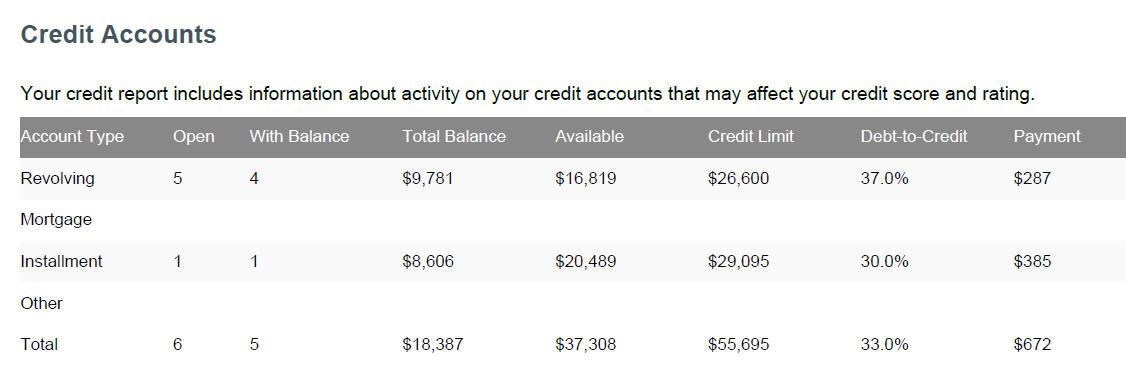

- Your current and past debt

- Public records in your name:

-

- Judgments

- Garnishments

- Bankruptcies

- Liens

-

- Inquiries:

-

- Regular – Remain on credit report for 2 years; may affect credit score

- Promotional – Do not affect credit score

- Account Review – Do not affect credit score

-

Some of the considerations employers make when reviewing your credit report are very subjective and may vary greatly from one hiring manager to another even within the same organization. In many cases it is difficult to prove that your credit report was the source of “adverse action” on the part of the employer. For example, if you have past due accounts or accounts that are in collection, a hiring manager may decide not to consider you for the position because they do not want to risk productivity loss due to potential collection calls made to you at work. The payroll manager may have explained the liability the company faces if wage garnishments are not processed correctly and encouraged managers not to hire those with outstanding garnishments. (An employee cannot be terminated because of garnishments, but there is nothing that says an employer can not choose not to hire a person with outstanding garnishments.)

Some employers look at the amount of debt a potential or current employee has and compare it to the salary being offered. Employers want employees who are 110% committed to the company. Right or wrong, they do not want employees that are “out the door” at

In some industries, especially those that deal with money and security, an employee or potential employee with a lot of debt is considered a security risk. Employers think the individual will be susceptible to influence that could lead to criminal acts or conspiracy.

Multiple social security numbers on a credit report are a “red flag” to employers. This is of increasing concern to employers as the illegal immigration debate escalates.

Consumer credit reports are not to contain medical information. Employers are not allowed to discriminate against employees with illnesses and other medical conditions. However, unpaid medical bills usually appear on credit reports with the provider identified. It is not uncommon for unpaid medical bills to be turned over to collection agencies 90 days after services are rendered regardless of the payment arrangements made with the provider. Collection agencies immediately report the account to the credit reporting bureaus. As an example, you may be healthy but an employer could see that last year you, or someone for whom you were financially responsible, received services from a cancer center. The employer’s immediate question would be, “How might this impact on the job performance?”

It is important to know that even though employers can be as subjective as they want to be when making employment decisions, the minute your credit report is requested, you have rights that employers must adhere to. In any case where information in a consumer report is a factor in an employer’s decision — even if the report information is not a major consideration — the employer must follow the procedures mandated by the FCRA.[i]

A job applicant gave a potential employer authorization to obtain a consumer report. He forewarned his potential employer that due to the loss of his prior job as part of corporate downsizing five months earlier, there were some late payments that might appear on his credit report. When the potential employer made the decision not to hire the applicant they said that although the applicant’s credit history was poor, the applicant's lack of relevant experience carried more weight in their decision not to hire.

****

The applicants for a sensitive financial position have authorized the brokerage firm at which they are applying to obtain credit reports. The firm rejected one applicant, whose credit report showed a debt load that the hiring manager considered too high for the proposed salary, even though the report showed a good repayment history. The firm turned down another, whose credit report showed only one credit account, because the managing partner wanted someone who had shown more financial responsibility.

In both of these cases, the employers are required to provide the applicants a pre-adverse action disclosure before rejecting their applications— even when the information isn't negative.

In each case where information in a consumer report influences an employer’s decision – even with long-term employees being considered for reassignment or promotion – the employer must provide the employee with a pre-adverse action disclosure. The employee also must receive an adverse action notice once the employer selected another individual for the job.[ii]